new short term capital gains tax proposal

1800-258-5899 9 am to 6 pm. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and the amount of time the investment was held.

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Know More about Income Tax Slab.

. Capital gains are also taxed a bit differently than other types of income. More long-term capital gains may push your long-term capital gains into a higher tax bracket 0 15 or 20 but it will not affect your ordinary income tax bracket. What Bidens Tax Proposal May Mean For The 1031 Exchange.

You also invest in a new property that year and that property makes a loss of 20000 for that. Find out the latest Income Tax Slab Rates for taxpayers as per the new Union Budget 2022. The highest in the OECD at 627 percent see.

In the United States of America individuals and corporations pay US. For additional information related to the Agreement and Plan of Merger dated as of January 18 2022 by and among Activision Blizzard Microsoft Corporation and Anchorage Merger Sub Inc a wholly owned subsidiary of Microsoft Corporation please refer to the Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on March 21 2022 and. We divide capital gains into two primary categories long term capital gains and short term capital gains.

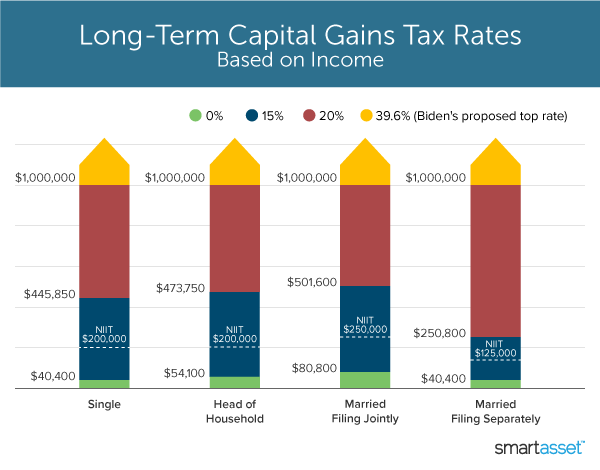

Taxing Capital Gains. And simplifying the tax code. However a 28 percent federal corporate income tax rate combined with Bidens proposal to tax long-term capital gains and qualified dividends at an ordinary income tax rate of 396 percent for income earned over 1 million would make the top integrated tax rate on corporate income in the US.

If youve owned something for one year or less when you sell it it will be classified as short term capital gains. The Tax Cuts and Jobs Act would reform the individual income tax code by lowering tax rates on wages investment and business income. New Income Tax Slabs.

The plan would lower the corporate income tax rate to 21 percent and move the United States from a worldwide to a territorial system of taxation. Short-term capital gains or losses are determined by the net profit or loss an investor experienced on the sale of an investment property that was owned for less than 12 months. Find tax rates for 2022-23.

Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold. Broadening the tax base.

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Tds Rate Applicable On Mf Redemptions By Nris For Ay 2021 22 Mutuals Funds Capital Gain Fund

How To Set Off Short Term Long Term Capital Losses On Stocks Mfs

Selling Stock How Capital Gains Are Taxed The Motley Fool

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How Roth Ira Conversions Can Escalate Capital Gains Taxes Financial Planning Capital Gains Tax Capital Gain Roth Ira Conversion

How High Are Capital Gains Taxes In Your State Tax Foundation

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Capital Loss Set Off Rules On Sale Of Stocks Equity Mutual Fund Schemes Mutuals Funds Budgeting Fund

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

The Capital Gains Tax And Inflation Econofact

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

What S In Biden S Capital Gains Tax Plan Smartasset

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World